Unable to pay property taxes, now what?

Every year, people find themselves in a situation where they are unable to pay their property taxes. The bill comes in the mail and thinking they will be able to pay later, they put it off. Often they end up forgetting about the bill, or they never actually get to a point where they are able to make the necessary payment. The next time they think about or address the situation, the interest has built up so high that their tax bill is now a truly unreachable number. If you are in this position, you may find yourself wondering..

- What happens if I can’t pay my taxes?

- Can I pay my taxes late?

- Will I be evicted if I don’t pay? How long do I have?

- Can I sell my house if I owe taxes?

We have helped many Hamilton County residents in this exact situation, and we can do the same for you. We will walk you through the process and offer a solution that meets your needs! You can and will lose your house if you do not pay your property taxes. If the situation progresses to that point, it means that you will be evicted from your house and receive no money. Let us help you before it comes to that!

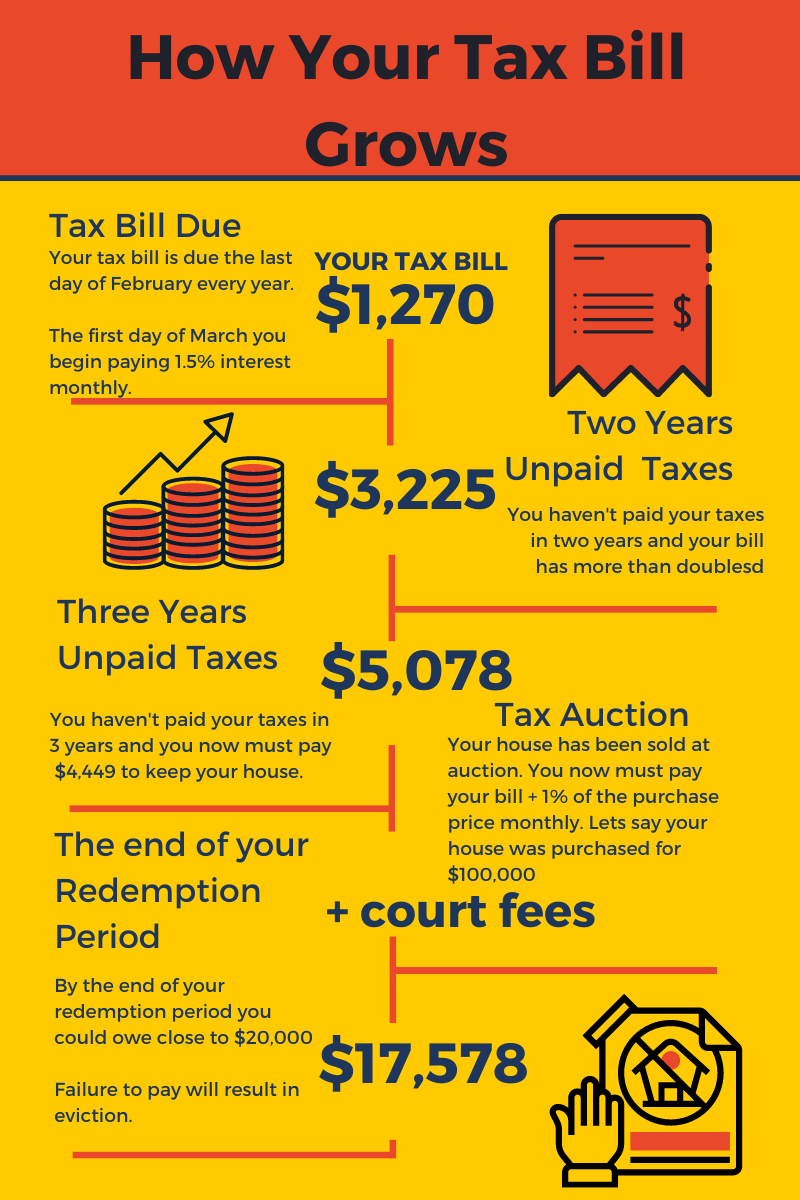

Before we jump into how we can help, let’s explore the Hamilton County Tax process. As you read this section I want you to pay close attention to the different steps in the process and how your tax bill grows. The most important thing to remember is this: no matter what stage you find yourself in, we CAN find a solution for your property. However, throughout the process there are fees, interest, and taxes building your bill continuously. The longer you wait, the less money goes into your pocket! Time is quite literally money right now.

Hamilton County Tax Process

Every September, Hamilton County mails property tax bills. You are required to pay this bill by the last day of February the following year. If you find yourself struggling to pay one year of property taxes, this is the best time for you to contact us. Every day after February 28th your bill begins building interest. The interest grows by 1.5% monthly, which is 18% annually. (See our chart for how your bill grows.) If you are past this point do not panic! We still have options and we can still help.

Another year goes by and the tax bill shows up again. This is a pivotal point in the tax process. If you are unable to pay your property taxes, and interest from the year past and now another year of taxes has been all added together, you are getting dangerously close to your house going to Auction. After 2 years of unpaid taxes you have the ability to pay 1 years worth of taxes to keep your house out of the Auction in June. If you cannot pay one year of your tax bill, contact us now and you will get exponentially more money in your pocket than you will if you wait any longer.

Once you hit the point in which you have been unable to pay your taxes for three years in a row, your house is added to a list of properties that will go to Auction the first week of June. The silver lining is that you can pay ALL of your taxes and ALL of the interest BEFORE the auction and you will be able to save your house from being sold to the highest bidder. This means three years of property taxes and all the interest MUST be paid between February 28th and the beginning of June or your house will be put on the Auction block. If you are unable to pay by this point, it is unlikely that you will be able to pay the required amount after the auction as the “redemption price” (or price of all unpaid property taxes, interest, and court fees) will begin growing aggressively from this time onward. Please reach out to us so that we can get you the most for your property, continuing to wait will only result in greater financial loss and eventually you will be evicted from your house.

If you have still been unable to pay your property taxes and late fees by the first Thursday of June, your property will be sold at auction to the highest bidder. The good news is that the ownership of your property DOES NOT transfer immediately. After the auction, a judge will sign off on the purchase of your property and court fees will be added to your already substantial tax bill. From the day the judge signs, you have one year to redeem your property by paying what is called the “Redemption Price”. This includes ALL taxes, interest, and additional fees (which are going to go up at this point: see the drastic jump on our chart after the auction.)

The bad news is that, at this point, every day you wait to pay the Redemption Price the amount you owe will grow. After the auction, court fees will be added to your already significant tax bill as well as an additional interest (1% of the purchase price at auction). So if your property is sold for $100,000 at auction your bill will be growing by an additional $1,000 a month. This means that, for every month you wait to pay or call us, $1,000 is falling through your fingertips.

One year after the judge signs off on the purchase of your property at auction, the ownership will transfer out of your name and into the purchaser. You will be evicted from your property and you will not be able to sell the property in order to secure funds for a new place to live. DO NOT let this happen to you and your family. Find out how we can help, and learn about your options as soon as possible.

How Can We Help?

To start, fill out our form at the bottom of this page. Our team will reach out to you directly and obtain all necessary information. At that point we will set an appointment to meet with you as quickly as possible with a plan to get your taxes paid, along with a cash offer on your house.

We will purchase your property and help you get out of debt with the county. This will give you the opportunity to put money in your pocket before your home is taken, giving you the means to find a new place to live. Even better? We will close on your timeline to ensure you have ample time to find the perfect place to start fresh with a clean slate. If you continue to wait, eventually you will be evicted from your house and walk away with nothing. Let us find a solution for your property, don’t wait another day to call and find out how we can help you!